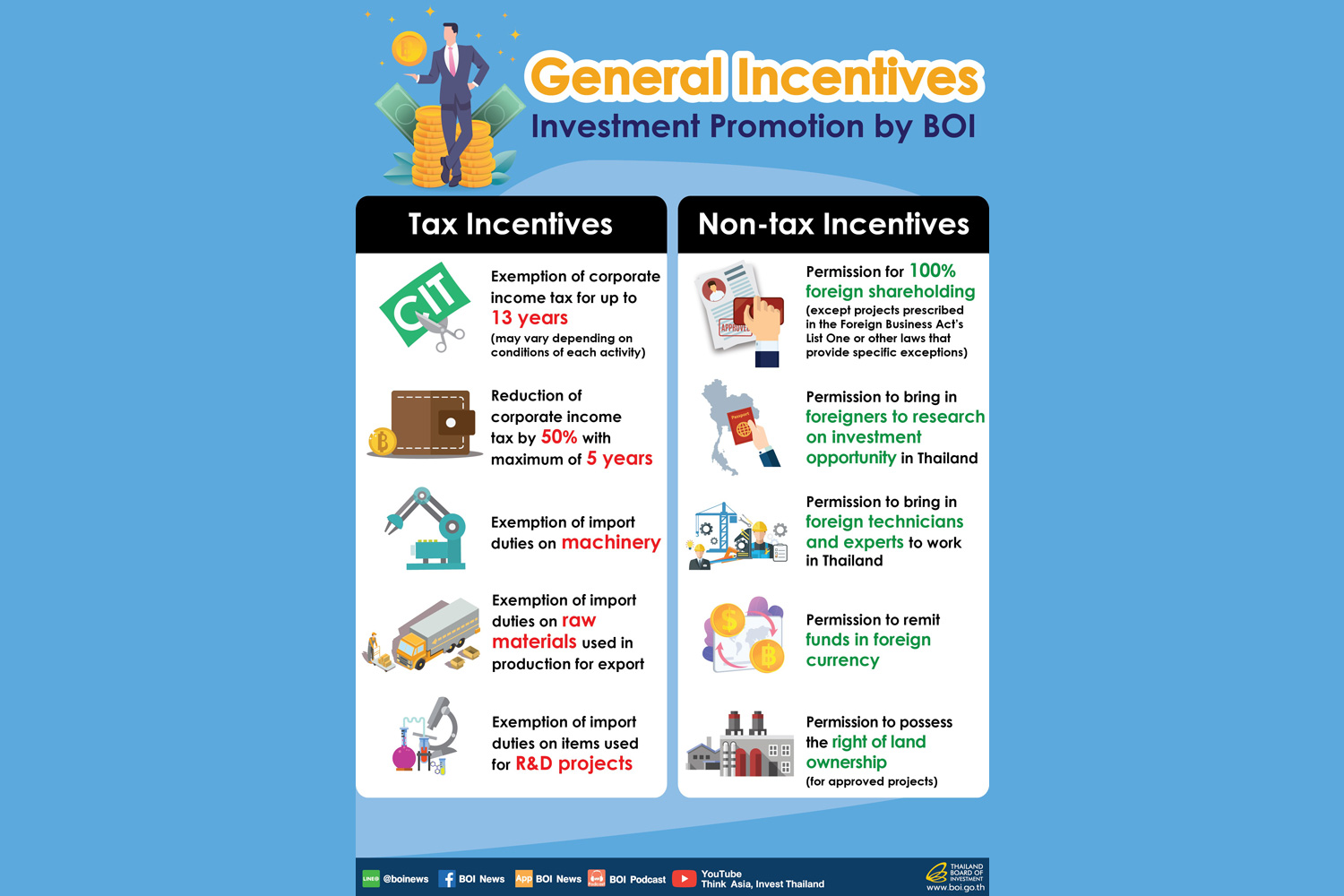

Tax Incentives

• Exemption of corporate income tax (CIT) for up to 13 years (may vary depending on conditions of each activity).

• Reduction of CIT by 50% with maximum of 5 years.

• Exemption of import duties on machinery.

• Exemption of import duties on raw materials used in production for export.

• Exemption of import duties on items used for R&D projects.

Non-tax Incentives

• Permission to bring in foreigners to research investment opportunities in Thailand.

• Permission to bring in foreign technicians and experts to work in Thailand.

• Permission to remit funds in foreign currency.

• Permission to possess the right of land ownership (for approved projects).

For more information, please contact: Interloop Solutions & Consultancy

Tel. +66(0) 97-106-9113

Line ID: @inlps

Website: InterLoop

Source: Bangkok Post

Leave a Reply